Supply chain fragility, the push to achieve net-zero emissions by 2050 as part of a decarbonised future and rising geopolitical tensions provide the backdrop to the Australian Government’s decision to put $2 billion on the table to assist critical mineral projects.

There is plenty of upside for Australia if it succeeds — particularly in downstream processing.

The International Monetary Fund, in its latest World Economic Outlook, names Australia in a group of “stand out” countries for production and reserves of critical metals that would benefit from increasing demand.

The IMF focused on just four critical metals — lithium, copper, cobalt, and nickel — without considering the wider suite of minerals.

“In the net zero by 2050 emissions scenario, the demand boom would lead to a sixfold increase in the value of metal production — totalling $US12.9 trillion over the next two decades for the four energy transition metals alone, providing significant windfalls to producers,” the IMF report said.

“Prices would reach historical peaks for an unprecedented, sustained period under the net zero by 2050 emissions scenario. The prices of cobalt, lithium, and nickel would rise several hundred per cent from 2020 levels.

“Cobalt and lithium are probably the most promising rising metals. In the IEA’s Net Zero by 2050 emissions scenario, total consumption of lithium and cobalt rises by a factor of more than six, driven by clean energy demand, while copper shows a twofold and nickel a fourfold increase in total consumption.”

But the IMF also warned that demand was hard to predict and would be affected by issues including technological change and policy decisions.

The IMF report is in line with assessments from the Federal Department of Industry, Science, Energy and Resources, which says Australia’s potential extends from mine production to downstream investment in value-adding processes.

Critical minerals are used widely, including in mobile phones, flat screen monitors, wind turbines, electric cars, solar panels, and defence and other high-tech applications.

But they can be difficult to find and mine, and environmentally challenging to process.

As an indicator of just a slice of the demand, DISER says the electric vehicle fleet size — which needs lithium, cobalt, nickel and graphite for batteries, and rare earth elements and copper for permanent magnets — is projected to increase 30 per cent a year to 2050.

Global stationary battery storage is projected to increase 8 per cent a year to 2050.

Global wind capacity for power generation — which require neodymium, praseodymium, and dysprosium just for the magnets — is projected to grow 6 per cent a year to 2050.

Australia has the world's third largest reserves of lithium and is the largest producer of lithium in the world.

It is ranked sixth in the world for rare earth elements and second for production and it has large resources of cobalt, manganese, tantalum, tungsten, and zirconium.

A World Bank report, Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transformation, said the production of minerals, such as graphite, lithium and cobalt, could increase by nearly 500 per cent by 2050 to meet the growing demand for clean energy technologies.

It estimates that over 3 billion tons of minerals and metals will be needed to deploy wind, solar and geothermal power, as well as energy storage, required for achieving a below 2°C future.

The COVID-19 pandemic has exposed the fragility of single source supply chains and increased the likelihood of resource nationalism, while at the same time geopolitical tensions, particularly involving China, the United States, and Australia, has brought into sharper focus the desire for alternative critical minerals markets.

IMDEX Chief Geoscientist Dr Dave Lawie said that until relatively recently, the world had been prepared to let China deal with the dirty and environmentally challenging aspects of processing critical minerals and rare earth elements.

“China was happy to oblige; buying mines around the world and developing its own mines and downstream processing facilities that has enabled it to control 80 per cent of the world’s rare earth elements production and refining, 80 per cent of the world’s refining of lithium and 77 per cent of the world’s battery production,” Dr Lawie said.

The Critical Minerals Facility announced by Prime Minister Scott Morrison followed a meeting in the US of the Quadrilateral Security Dialogue, (The Quad) comprising the leaders of India, Japan, the United States, and Australia.

Speaking after the Quad Summit, Mr Morrison said Australia could play a bigger role in a critical supply chain that is supporting the technologies of the future, and in so doing, supply the US, India, and Japan.

The Quad partnership — and its readiness to challenge China and establish new supply chains — could be what is needed to close the gap that has, until now, worked against broad scale development of critical minerals processing and given China the upper hand.

The Critical Minerals Fund will distribute grants and loan guarantees to underwrite risk and will be managed by Export Finance Australia and report to the Federal Minister for Trade, Tourism and Investment, Dan Tehan. It will operate for 10 years or until finance equivalent to $2 billion has been provided.

Dr Lawie said that the combined economic strength of the Quad could provide the impetus to break China’s dominance of critical minerals mining and processing.

“Extraction of rare earths from a chemical engineering point of view is complex and technically difficult,” he said. “The Chinese have the capacity to do it more cheaply and other countries have not been prepared to pay a premium for alternative supplies.

“This is changing but it may take the full weight of the Quad to underwrite the economics of these projects.

“Unlike commodities such as iron ore and base metals such as copper, lead, nickel, aluminium and zinc where there are defined and established markets, each critical mineral ore or deposit is unique and requires different mining and processing technology.

“And each of the critical minerals is exposed to market fluctuations based on technological advancements and new deposits being brought to market which could cause prices to rise or fall rapidly.

“It makes the economics of finding, defining, and mining critical minerals more complicated and financially risky.

“The pricing is much more opaque. Often before a mine even begins the owners would look to secure an offtake agreement for the entire production.

“Adding to the challenge is that refining and processing critical minerals has been environmentally risky and capital intensive.

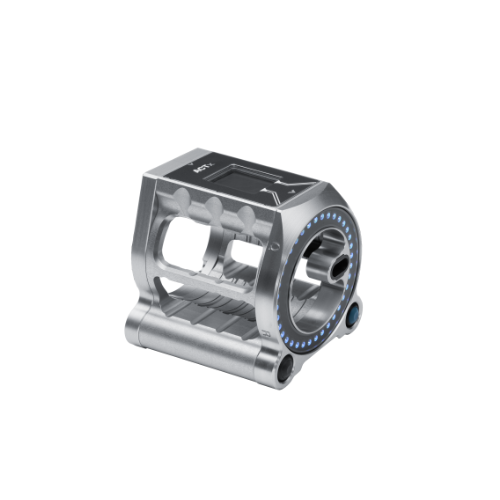

“New and emerging technologies could make the difference in defining and mining critical minerals because they are amenable to procession mining, which the CSIRO likens to keyhole surgery.

“This is made possible through the Internet of Geosensors, which provides a wealth of spatiotemporal rock knowledge around which informed decisions can be made.

“It’s easier to bring mines into production if you can precision mine and in so doing increase the resource conversion rate.

“With precision mining you can run at higher head grades and mining intensity, and with better processing. It changes the economics of a mine dramatically.

“The world has ceded control of rare earth elements and critical minerals to China — and its dominance has taken decades to emerge.

“The Australian Government’s Critical Minerals Facility is the start of attempting to rebalance the ledger, but it will take many years, a combination of new and emerging technologies, and a multinational approach to succeed.”

.png)

.png)

.png)

.png)